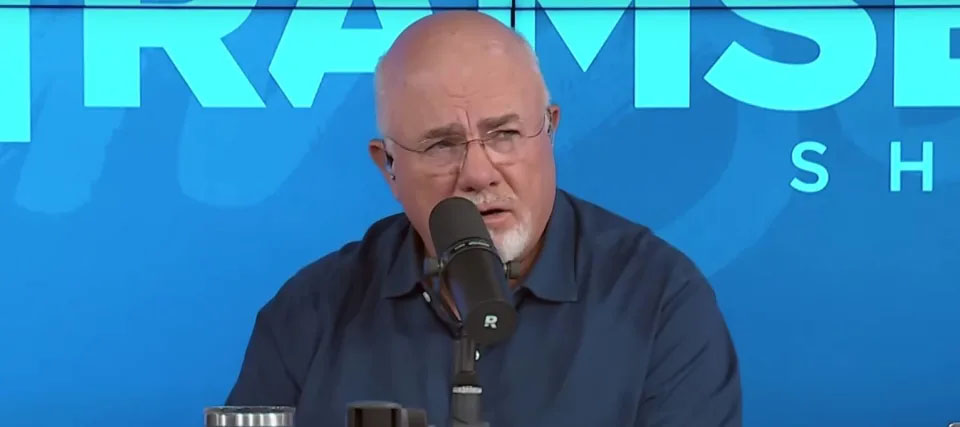

Dave Ramsey is busy once more: more stubborn and reckless, on the off chance that you can trust it, than a Philly fellow.

“Dave from Philadelphia” told the money master on a new Ramsey Show episode that he was “scarcely scraping by” on the family pay of $180,000. He was uncertain whether to save more, or apply for a line of credit to earn enough to pay the bills. While he’ll see the number ascent once his better half completes clinical school (she at present makes $70K as an inhabitant), the group of four has obligations and installments to fight.

According to his brand name style, Ramsey decided in favor of another decision.

“Choice ‘C,’ work more,” he told him, adding: “Might you at any point make sense of for me why you can’t get by with pay at $180,000?” he inquired. “I will be as pleasant as possible, Dave. You folks have lost your psyches.”

The (cost) beast under the children’s beds

Compelled to dig further, Dave from Philadelphia uncovered some eyebrow-bringing up youngster costs: no less than $50,000 in childcare educational cost for two, with when school care and paying a babysitter in the late spring months.

Perhaps you’re thinking what Ramsey said: “Would they say they are going to Harvard? What the poop!”

The man let it be known was an extravagant school — particularly given that his children were still pre-young. As a matter of fact, the normal expense of kid care in Pennsylvania stays simply above $17,000 per kid, somewhat more in suburbia, as per youngster care site TOOTRiS.

“We will take out educational loans for the four-year-old,” Ramsey prodded. “We’re boiling down to “That.”

Planning for savvy kid care is much more basic considering the costs numerous Americans can’t promptly get away: gas, protection, food and utilities, first of all. Financial plans can assume a critical part in managing things — particularly in the event that you start by counting your most recent three months of expenditure. What’s costing the most? What are the non-negotiables? Where can effortless, reasonable cuts be made?

And Ramsey’s ‘Choice C’?

As Ramsey recommended, pay from added work can balance the dollar figure of a credit. Ramsey avoids credits as a general rule, so agreeing with on a particular position hustle or even a temporary occupation while you make a secret stash can turn the numbers in support of yourself.

Nowadays, a part time job can be pretty much as straightforward as leasing your shed as stockpiling — which could net you around $160 for a 10’x10′ unit in Philly, as per RentCafe. Or on the other hand in the event that you have a parking spot you don’t utilize, you could lease it out for around $300 each month, as per WhereiPark. Pull off those two actions and that is $5,500-in addition to throughout the year not too far off.

When to think about a credit

Dave from Philadelphia obviously required a rude awakening on his youngsters’ “Harvard” kid care costs. However his significant other has zero drug school obligation, implying that their $180,000 pay has generally minimal monetary drag — and addresses over two times the $71,000 made by the normal American family starting around 2021, as indicated by the US Evaluation Agency.

Could a blend of cost cutting and a more modest credit seem OK for now, then, at that point? Maybe — however provided that you start by staying away from exorbitant interest Mastercards as the source. On the off chance that it’s an individual credit you have as a top priority, search around. Banks and other crediting offices need your business, so cause them to contend to give you the best rate.

Obviously, wedded individuals who plunk down with an unbiased party — for this situation, an expert monetary counselor — will get a much more clear picture as far as isolating requirements from needs and waste. All things considered, nobody needs to remain caught in monetary pre-school.